Once you’ve investigated available loans, you can begin to evaluate the most suitable choice to suit your needs. Making sure your lender will offer you a loan at your most popular quantity is often a requirement, but the lender might also have eligibility needs and state availability limitations that identify your capacity to implement, like your meant use for your resources. You may also want to take into account how fast the lender may mail you your cash soon after acceptance.

Your lender will show you whenever you’ll need to have to start out building loan payments, and most often, you’ll have an internet account to assessment your stability and make payments.

It is vital to note that any personal loan you have which has a 450 credit score score is likely to have a very substantial APR and a pricey origination cost. If at all possible, you might want to make an effort to borrow... read through comprehensive respond to Did we answer your issue?

In addition, think about improving your credit rating rating in advance of applying for your loan, as this can assist you qualify for better loan phrases Later on.

It could be reasonably straightforward to get a $6k loan with regards to the lender you use with. Banks to tend to contain the strictest eligibility demands, although online lenders ordinarily have a great deal more lenient needs.

Set-amount APR: Variable rates can go up and down in excess of the life time of your loan. With a fixed charge APR, you lock within an curiosity amount for the duration from the loan's time period, which means your month to month payment would not change, creating your funds much easier to plan.

If a lender provides prequalification, you could see the phrases there's a chance you're made available with out impacting your credit history.

Unsecured loans commonly feature greater curiosity premiums, lessen borrowing limits, and shorter repayment terms than secured loans. Lenders might often demand a co-signer (a individual who agrees to pay for a borrower's credit card debt whenever they default) for unsecured loans Should the lender deems the borrower as dangerous.

Lots of buyer loans slide into this class of loans which have frequent payments which can be amortized uniformly about their life span. Program payments are made on principal and interest right up until the loan reaches maturity (is solely compensated off). A few of the most familiar amortized loans incorporate mortgages, auto loans, scholar loans, and personal loans.

Variable-level personalized loans have desire prices that fluctuate in step with the Lender of copyright’s prime price. This means you’ll pay off a lot more of your respective principal on a monthly basis When the costs go down, but finish up paying far more in fascination if fees go up.

Straightforward desire is fascination that's only calculated on the First sum (the "principal") borrowed or deposited. Usually, very simple fascination is ready as a set share for your period of a loan.

Depending on your lender and bank, you might be able to obtain your money in just a couple of days of approval.

The easy Interest Calculator calculates the curiosity and conclude harmony based on the simple interest formulation. Click on the tabs to compute the several website parameters of The easy fascination components.

Interest rates certainly are a standalone proportion that receives included to your loan sum based upon things like your credit score score. APR is the cost of your interest charges in addition the expenses you'll need to pay for in your loan (which include origination service fees and shutting prices).

Mara Wilson Then & Now!

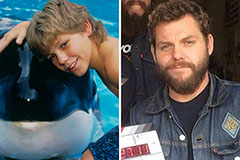

Mara Wilson Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now!